harrisburg pa local services tax

Church World Service Harrisburg. Local Services Tax forms for Individuals.

Latino Hispanic American Community Center.

. Harrisburg also received authority to raise the tax under Act 47 from the Commonwealth Court of Pennsylvania. Whether you are a taxpayer making a payment or a public official looking for a collection solution for your community we are ready to. A total of 156 a year to support the services I consume or might needroads police fire health inspections etcover some 2000 annual working hours seems like a fair price to pay.

Political subdivisions that levy an LST at a rate that exceeds 10 must exempt from the tax taxpayers whose total earned income and net profits from all sources within the political subdivision is. Links for Individual Taxpayers. Individual Taxpayer Mailing Addresses.

Local Services Tax forms for Individuals. The minimum fee is 100. Examples of business worksites include but are not limited to.

Harrisburg is authorized to set the Local Services Tax rate at 156 per year under the state Financially Distressed Municipalities Act also known as Act 47. Making tax collection efficient and easy for over 35 years. 22 rows The Local Services Tax LST for cities in Pennsylvania is withheld on a mandatory.

Local Income Tax Requirements for Employers. 2 South Second Street. Nonresidents who work in Harrisburg also pay a local income tax of 100 the same as the local income tax paid by residents.

Factories warehouses branches offices and. But in Harrisburg the situation is much more pressing. 8391 Spring Rd Ste 3 New Bloomfield PA 17068.

The Local Services Tax or LST is paid on each worker in the city via withholding from the workers paychecks. Individual Taxpayer Mailing Addresses. You are required to include a list of individual employees and their social security numbers with your quarterly return.

The tax which is deducted from the paychecks of people who work in the city is being tripled from 52 per year to 156 per year. Dauphin County Property Info. The name of the tax is changed to the Local Services Tax LST.

Employers with worksites located in Pennsylvania are required to withhold and remit the local Earned Income Tax EIT and Local Services Tax LST on behalf of their employees working in PA. First theres the fact that the citys main employer the state government pays no property tax. Monday - Friday from 800 AM to 430 PM.

See reviews photos directions phone numbers and more for the best Tax Return Preparation in Harrisburg PA. This is the date when the taxpayer is liable for the new tax rate. 800am to 400pm Weekends.

Governors Center for Local Government Services 400 North Street 4th Floor Harrisburg PA 17120-0235 Phone. FAQ for Individual Taxpayers. If the total LST rate enacted is 10 or less the tax is to be collected in a lump sum.

Dauphin County Office of Tax Assessment. The provision would extend Harrisburgs ability to levy an enhanced Local Services Tax on all people who work in the city for 15 years. The increase only applies to people who make more than 24000.

Each payment is processed immediately and the date is equal to the time you completed the transaction. Earned Income Tax Regulations. A 36 tax would be collected at 69 cents a week for employees paid weekly or at 3 a month for employees that are paid monthly.

Earned Income Tax Regulations. We offer user-friendly online services coupled with responsive customer support to 900 school districts and municipalities throughout Pennsylvania. 9 hours agoWASHINGTON AP As Uber aggressively pushed into markets around the world the ride-sharing service lobbied political leaders to relax labor and taxi laws used a.

Your Local Withholding Tax Rates HOME. 8391 Spring Rd Ste 3 New Bloomfield PA 17068. Links for Individual Taxpayers.

Residents of Harrisburg pay a flat city income tax of 100 on earned income in addition to the Pennsylvania income tax and the Federal income tax. The provision would extend Harrisburgs ability to levy an enhanced Local Services Tax on all people who work in the city for 15 years. FAQ for Individual Taxpayers.

Each worker pays up to 1 a week but in cities that have Act 47 status that can rise to 3 a week. Tuesdays and Wednesdays 830am to 230pm. A convenience fee of 235 for credit cards 250 for business cards and 150 for debit cards is charged.

Please make a selection from the menu below to proceed. This service provided by Value Payment Systems allows you to pay your City of Harrisburg PA payments online.

3417 N 6th St Harrisburg Pa 17110 Realtor Com

3913 N 6th St Harrisburg Pa 17110 Realtor Com

1944 Chestnut St Harrisburg Pa 17104 Realtor Com

6625 Rockford Dr Harrisburg Pa 17112 Realtor Com

1306 Vernon St Harrisburg Pa 17104 Mls Pada2013136 Zillow

13 Fun Things To Do In Harrisburg Pa Under 30

2923 Derry St Harrisburg Pa 17111 Realtor Com

320 S 15th St Harrisburg Pa 17104 Realtor Com

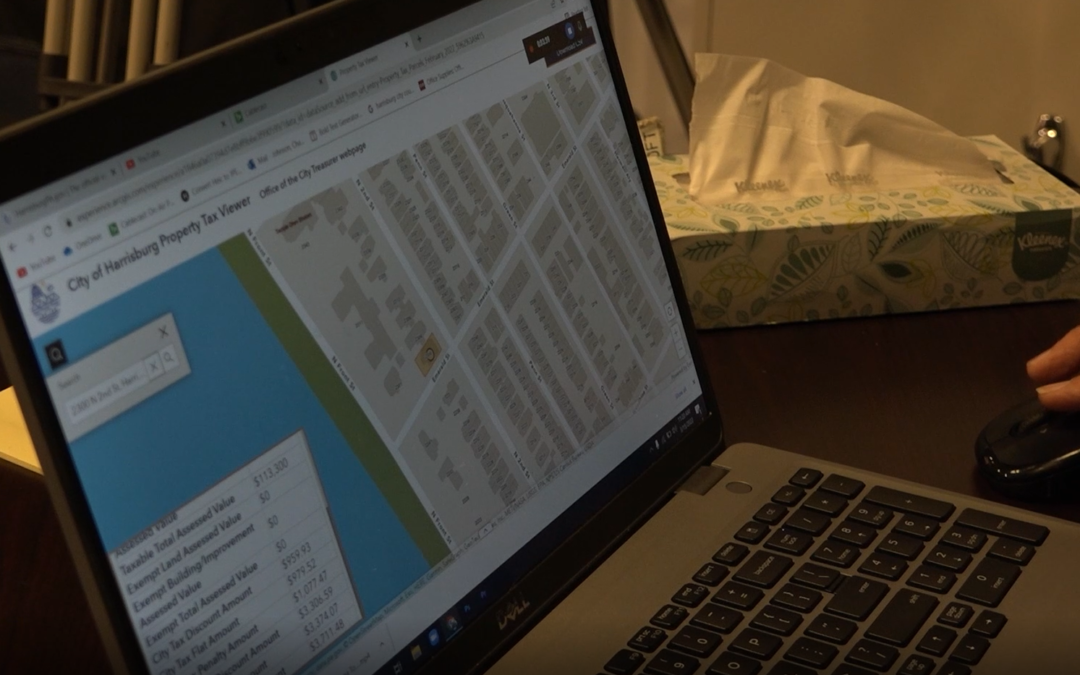

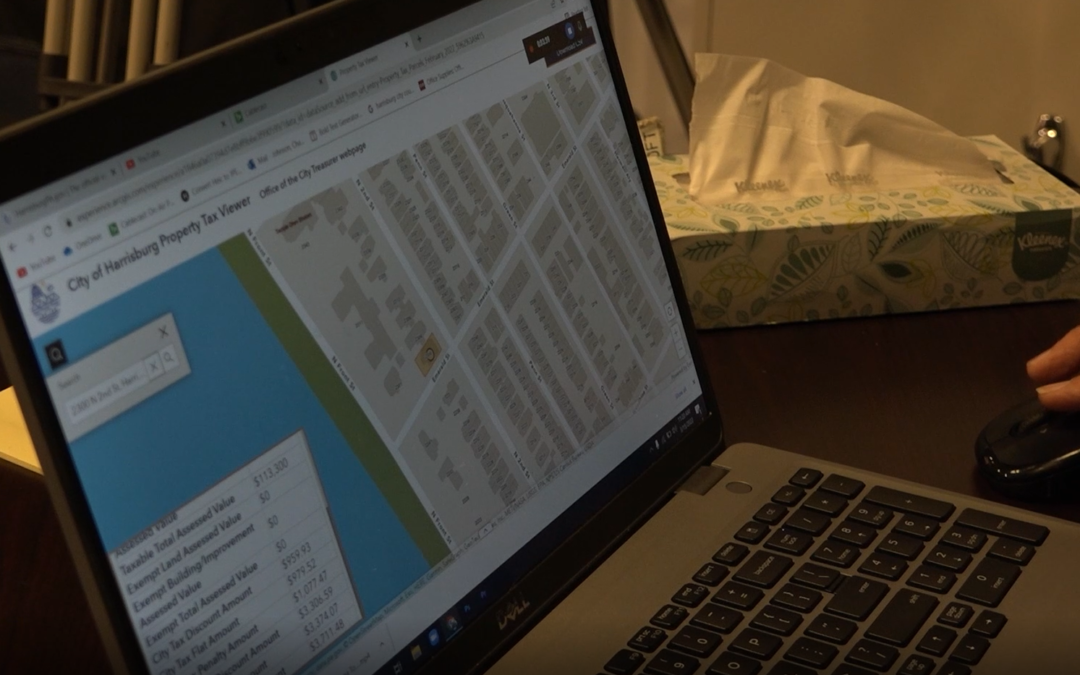

New Property Tax Viewer On Harrisburgpa Gov Gets You Ready For Tax Season City Of Harrisburg

1406 State St Harrisburg Pa 17103 Realtor Com

257 Sassafras St Harrisburg Pa 17102 Realtor Com

323 N Front St Harrisburg Pa 17101 Realtor Com

14 S 18th St Harrisburg Pa 17104 Mls Pada2010022 Zillow

Movers In Harrisburg Pa Sp Network Moving Local Moving Local Move Moving Services Moving Company

218 Boas St Harrisburg Pa 17102 Realtor Com

Harrisburgpa Gov The Official Website For The City Of Harrisburg

Pin By Raymond Whitacre On Oh I Love This City Hbg Pa Mechanicsburg Pa Harrisburg Pennsylvania Mechanicsburg Pennsylvania